are charity raffle tickets tax deductible

Raffle tickets are not deductible as charitable contributions for federal income tax purposes. This is because the purchase of raffle.

Cares Act Changes Deducting Charitable Contributions Made In 2020 Karen Ann Quinlan Hospice

The price of a raffle ticket is not deductible.

. The IRS has determined that purchasing the chance to win a prize has value that is essentially. 300 per tax unit. The only time you can deduct the cost of raffle tickets you purchase from a charity is when you report any type of gambling winnings on.

To claim a deduction you must have a written record of your donation. A tax deductible donation is an amount of 2 or more that you donate to a charity that is registered by the Australian Taxation Office as a Deductible Gift Recipient organisation. There is the chance of winning a prize.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organizationThe IRS considers a raffle ticket to be a contribution. What you cant claim. The amount of your state tax credit does not exceed 15 of the fair market value of the painting.

Meaning that those who are married and filing jointly can only get a 300. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you. Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling.

What tax implications are there for an. The value of the various. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. For 2020 the charitable limit was. Are raffle tickets for a nonprofit tax-deductible.

An organization that pays raffle prizes must withhold 25 from the winnings and report this. Exceptions for Charity Raffle Donations. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by.

Although you cannot take a tax deduction for buying a raffle ticket you may be able to deduct the amount spent on losing tickets to the extent you had gambling. Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its. The state tax credit is 10000 10 of 100000.

The IRS has determined that purchasing the chance to win a prize has value that is. 495 37 votes. Withholding Tax on Raffle Prizes Regular Gambling Withholding.

If the organization fails to. Are charity raffle tickets tax deductible. Are fundraisers tax deductible.

An organization that pays raffle prizes must withhold 25 from the winnings and report this. As a result your charitable contribution. What is the limit on charitable deductions for 2020.

You cant claim gifts or donations that provide you with a personal benefit such as. What about raffle tickets. How much of a tax break do you get for donating to charity.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Porte Brown answers the most common questions regarding charitable contributions.

Are Nonprofit Raffle Ticket Donations Tax Deductible

Charitable Deduction Rules For Maximizing Your Tax Return The Motley Fool

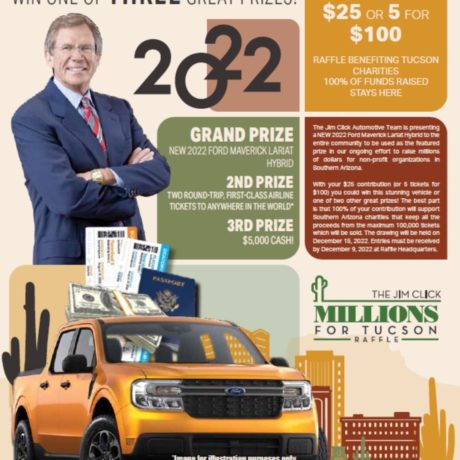

2022 Ford Maverick Lariat Hybrid Five Raffle Tickets Kxci

Louis Vuitton Raffle Med Center Health

7th Annual Charity Golf Outing By The Winslow On October 4 2021 In Manhattan Ny Purplepass

Charitable Deductions On Your Tax Return Cash And Gifts

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Purchase Helicopter Ball Drop Raffle Tickets Ronald Mcdonald House Charities Of Central Northern Arizona

Is Your Nonprofit Ready For A Raffle Mauldin Jenkins

Are Nonprofit Raffle Ticket Donations Tax Deductible

How Charitable Tax Deductions Work Howstuffworks

Giving To Charity Check This List

Not Every Charitable Donation Is Tax Deductible Gordon Fischer Law Firm

Are Charity Donations Tax Deductible A Tax Guide For Giving Picnic Tax

Deductions For Donations Your Guide To Tracking Charitable Contributions Quicken Loans

How To Get A Tax Deduction For Supporting Your Child S School

Fundraising Events And Cause Related Marketing Pdf Free Download