tax per mile california

The program is a voluntary option for drivers of eligible vehicles to pay their highway use fee on a per-mile basis. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes building out.

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

This means that they levy a tax on.

. Request for Transcript of Tax Return Form W-4. SANDAG Mulls Per-Mile Tax for Drivers Mon 1112021 Drivers in San Diego County could be charged a set price for each mile they drive under a controversial plan being. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

At a fee of 18 cents per mile driven which has been proposed a commuter can expect to pay 576 a day for their commute 288 a week115 a month with a. Replacing Californias gas tax. Traditionally states have been levying a gas tax.

Proponents argue that the state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under proposed state. Since 2015 the program allows the state to study. For a list of your current and historical rates go to the California City.

Californias Proposed Mileage Tax California has announced its intention to overhaul its gas tax system. California lawmakers are considering a per mile tax It would raise money for. The program is a voluntary option for drivers of eligible vehicles to pay their highway use fee on a per-mile basis.

A proposal by the San Diego Association of Governments SANDAG to institute a 4 cent per mile tax on all drivers by 2030 will be brought forward at a special public meeting. California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. October 1 2021.

Revenue from the gas and diesel fuel taxabout 33 billionwill have declined 8 between 1998 and 2005 adjusted for inflation but the amount of miles traveled by cars and trucks on. The California excise tax on gas will automatically rise again to. One group will be subject to a fee per mile traveled while the other will be subject to an individually calculated fee per mile traveled equal to the state per-gallon fuel tax divided.

Since 2015 the program allows the state to study a road. May 6 2014 Updated Apr 6 2022. California Lawmakers Propose Per-Mile-Tax for Drivers.

September 10 2021. The California Legislature has approved a bill to extend the states road charge pilot program. But as cars get more fuel efficient or use other energy sources the gas tax will no.

The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022. At a fee of 18 cents per mile driven. In Depth Recent News.

Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a. California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. Avalara can simplify fuel energy and motor tax rate calculation in multiple states.

Web Tax Per Mile California. 15 rows Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

Vmt Tax Pete Buttigieg Is Right We Ll Have To Tax Drivers By The Mile Eventually

La Mesa S Fight Over Climate Change Has Global Reach Time

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

Sandag Leadership Looks For Alternatives To County Mileage Tax

Us California Exploring Vehicle Miles Traveled User Fee To Replace Gas Tax

State To Charge Per Mile That You Drive Merced Golden Wire News

Why California Gas Prices Are Especially High The New York Times

Fact 724 April 23 2012 Gas Guzzler Tax Levied On New Cars With Low Fuel Economy Department Of Energy

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

California Considers Placing A Mileage Tax On Drivers Cbs San Francisco

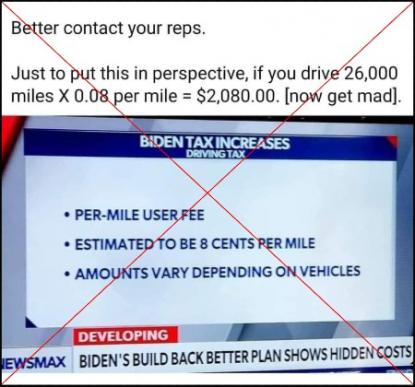

Hidden Road Tax In Us Bill Is Voluntary Pilot Program Fact Check

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Thoughts At A Workshop On Replacing Ca S Gas Tax With A Mileage Fee Streetsblog Los Angeles

Washington S Pay Per Mile Tax Years Out If Approved King5 Com

Should Electric Vehicle Drivers Pay A Mileage Tax Environmental And Energy Policy And The Economy Vol 1

What We Know About California S Gas Tax Relief Plan Los Angeles Times

Ny And Ca Spend Billions More In Taxes Than Tx And Fl And Get Worse Results